The International Commercial Terms (Incoterms®) is a set of 11 internationally recognized rules developed by the International Commercial Commerce (ICC). The rules define the responsibilities of buyers and sellers in international trade.

Two popular concepts under Incoterms are Delivered at Place (DAP) and Delivered Duty Paid (DDP), which can confuse business owners. In this guide, you will learn what DAP is in shipping and how it compares to DDP Incoterms. You’ll also learn how to select the best option.

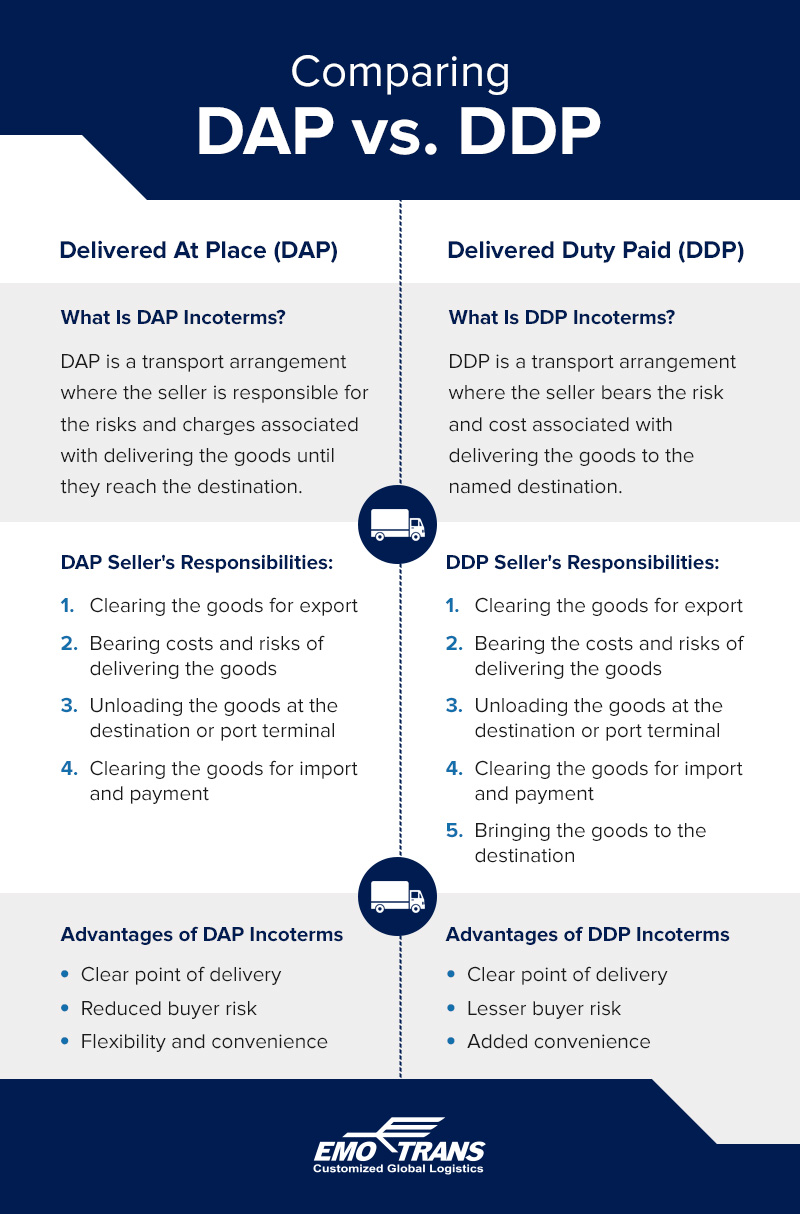

What Is DAP Incoterms?

DAP is a transport arrangement where the seller is responsible for the risks and charges associated with delivering the goods until they reach the destination. The goods must be available for import clearing and unloading. Once these conditions are met, the costs and risks transfer to the buyer.

The buyer pays the unloading costs and customs charges, including the entry and inspection fees, taxes and import duties. In case of a delay, they may also pay storage fees. Below is a summary of the seller’s obligations:

- Clearing the goods for export

- Bearing costs and risks of delivering the goods

- Unloading the goods at the destination or port terminal

- Clearing the goods for import and payment

Under DAP Incoterms, the seller takes on more responsibility for the shipment’s delivery. For other Incoterms like Ex Works (EXW) and Free Carrier (FCA), the buyer assumes more responsibility and risk earlier in the shipping process. Parties must clearly understand their obligations and liabilities when using DAP to avoid misunderstandings or disputes.

What Is DDP Incoterms?

DDP is a transport arrangement where the seller bears the risk and cost associated with delivering the goods to the named destination. The seller must clear the goods for import and pay all applicable fees, including clearance charges, taxes and duties. Below is a list of the seller’s responsibilities:

- Clearing the goods for export

- Bearing the costs and risks of delivering the goods

- Unloading the goods at the destination or port terminal

- Clearing the goods for import and payment

- Bringing the goods to the destination

Under DDP Incoterms, the seller assumes a higher level of responsibility and cost than with DAP. This arrangement benefits buyers who want a more hands-off approach to importing goods. The seller handles customs procedures and pays additional costs. Like DAP, parties must understand their respective roles to avoid disputes.

DAP vs. DDP Incoterms: Similarities and Differences

DAP and DDP are common Incoterms that give the seller a significant level of responsibility and risk in the shipping process. While the two closely resemble each other, clear differences also exist.

Similarities

DAP and DDP are similar in several ways, including:

- Responsibility for delivery: In both DAP and DDP terms, the seller is responsible for delivering the goods to the buyer at the agreed-upon destination.

- Risk transfer: Under DAP and DDP terms, the risk transfers from the seller to the buyer at the point of delivery.

- Cost responsibilities: The seller is responsible for various costs associated with transporting and delivering the goods.

Differences

Differences between DAP and DDP Incoterms include:

- Payment of import duties and taxes: Under DAP, the seller delivers the goods to the agreed-upon destination but does not pay import duties and taxes. In contrast, under DDP, the seller delivers the goods to the buyer’s named destination and pays the import duties and taxes.

- Risk transfer: In both cases, risk generally transfers from the seller to the buyer upon delivery of goods. However, since the seller handles customs clearance and duty payments under DDP, they are still responsible for potential risks during this process.

Advantages of DAP Incoterms

DAP arrangements have many benefits, such as:

- Clear point of delivery: DAP specifies a place of delivery, providing clarity to both parties.

- Reduced buyer risk: DAP provides some assurance to buyers that they will safely receive the goods at the point of destination.

- Flexibility and convenience: DAP is convenient for buyers, considering the seller will send the goods to the desired destination.

The downside is that the buyer pays the taxes, import duty and customs clearance charges.

Advantages of DDP Incoterms

DDP arrangements offer numerous benefits to parties during shipment:

- Clear point of delivery: Like DAP terms, there is clarity regarding the point of delivery.

- Lesser buyer risk: The seller assumes added risk during the customs clearing and import duty process, relieving the buyer of that burden.

- Added convenience: The seller handles the customs clearing and import duty processes, allowing the buyer to focus on other vital tasks.

The downside is that the seller takes on more responsibilities and risks, particularly during import clearance. On the other hand, this arrangement can enhance customer satisfaction.

Which Is Best for You?

Choosing between DAP and DDP Incoterms depends on various factors. The most important thing is selecting an option that suits your business and financial needs. Buyers who prefer that sellers handle customs clearing and import duties can choose DDP terms. Otherwise, DAP would be ideal.

Additionally, note that the option you select could affect the total transaction cost. Parties must discuss the details in advance and document them for clarity.

FAQs About DAP and DDP Incoterms

Here are answers to some frequently asked questions:

Who Is Responsible for Insurance Under DAP and DDP?

The seller is not obligated to provide insurance coverage for the goods. The parties may negotiate to secure coverage to protect against damage or loss during transit.

Are Both DAP and DDP Suitable for All Shipment Types?

You can use DAP and DDP for all transportation modes, but they suit different areas. Factors to consider include the destination country’s customs regulations, the nature of the goods and the parties’ preferences and capabilities.

Who Pays Shipping on DAP?

The seller pays the freight charges. Once the goods reach their destination, costs and risks transfer to the buyer.

Who Pays Freight for DDP?

The seller pays the freight charges and the export and import duties.

What Is an Example of DAP Delivery?

If a buyer in the United States purchases multiple consignments from another country, DAP terms will imply that the seller will pay to transport the goods from their storage to the buyer’s chosen destination.

What Is an Example of a DDP Incoterm?

If a buyer in the U.S. purchases goods from another country, the DDP terms require the seller to pay the freight charges and the import duties and taxes in the U.S.

Does DAP Include Duties and Taxes?

DAP excludes duties and taxes. The seller clears the goods for export, pays the freight and unloads them at the destination.

Do You Need a Customs Broker for DDP?

Customs brokers can be helpful in DDP shipments, considering the seller is in a different location.

Request a Quote From EMO Trans

EMO Trans is a global shipping and logistics company with decades of experience. We help businesses nationwide receive and transport goods conveniently and securely. Our team is ready to provide the support you need. Request a quote today!